By Robert Paul Wolff

In this lengthy essay, I will explain the relationship between the claim that capitalism arises through the expropriation of workers, and the claim, specific to Marx‚Äôs economic theory, that capitalism rests on the exploitation of the working class.¬Ý The term ‚Äúexploitation‚Äù in Marx‚Äôs writings has a specific technical meaning which I shall explain in good time, but we should start by recalling that ‚Äúto exploit‚Äù has two distinct and yet related uses in common speech.¬Ý To exploit something means to use it for some purpose.¬Ý ‚ÄúIn his architectural designs, Frank Lloyd Wright exploited the particular physical and scenic characteristics of the site on which a building was to be constructed.‚Äù¬Ý To exploit someone means to take advantage of that person for one‚Äôs own purposes.¬Ý ‚ÄúTrump exploits contractors whom he hires on his construction projects by using the expense of legal proceedings to get out of paying the bills he has run up with them.‚Äù¬Ý The first usage has no obvious normative implications.¬Ý No one save a Mother Earth enthusiast would blame Wright for exploiting nature in his designs.¬Ý The second usage at least prima facie does have normative implications.¬Ý Marx deliberately plays on this ambiguity in Capital.

Recalling that the sub-title of Volume I of Capital is Critique of Political Economy [not Critique of Capitalism,] let us begin where Marx does with the earliest stage in the development of Political Economy [or, as we would say, Economic Theory] as he found it when he entered into the debates of the new discipline.

Political Economy was born through the combination of two powerful conceptual innovations.¬Ý The first, advanced by the French thinkers known as Physiocrats, was the observation that the year-by-year productive activities of a nation are circular in structure.¬Ý The output of one annual cycle of production serves as the input into the next cycle.¬Ý The Physiocrats had in mind agriculture, where manifestly this year‚Äôs harvest is the source of next year‚Äôs seed, but their observation holds true for non-agricultural production as well, a fact put to use by Piero Sraffa in his short but vitally important work, Production of Commodities By Means of Commodities [1960.]

The second great innovation was Adam Smith‚Äôs introduction of the concept of natural price in his great work, An Inquiry into the Nature and Causes of the Wealth of Nations [1776.]¬Ý Smith observed that in the English markets of his day, familiar commodities had usual or customary prices, well known to experienced traders, which he called natural prices.¬Ý On any given day, the actual price paid for a bushel of corn or a yard of cloth might vary, due to temporary variations in supply or demand, but the natural prices could, he said, be counted on to reassert themselves.¬Ý Drawing on the physical theories of Isaac Newton, then considered the gold standard for intellectual work, Smith described the natural prices as ‚Äúcenters of gravity‚Äù that drew the fluctuating market prices to them.¬Ý Smith set himself to discover the factors determining natural prices.

Smith was not really interested in the prices of linen and coal and wheat.¬Ý His real interest was in economic growth, but to understand that, he believed that he needed to understand what determined the way in which the annual output of a nation got divided among the three great classes of society, the Landed Aristocracy, the Entrepreneurial Class [or Capitalists], and the Working Class.¬Ý And in the England of his day, what determined that dividing up was three very special prices:¬Ý the price of land, or rent, the price of capital, or profits, and the price of labor, or wages.

Smith advanced a very simple explanation of the determination of natural prices:¬Ý goods exchange in proportion to the amount of labor it takes to produce them.¬Ý Since in the 18th and 19th centuries the natural price of a good was sometimes called its value in exchange, or simply its value, this explanation came to be known as a Labor Theory of Value.¬Ý Smith knew that this explanation was not true when there was private ownership of land or when goods were produced using capital, such as tools, etc., as well as labor, but he had no idea how to solve those problems.

David Ricardo did.¬Ý In a brilliant theoretical tour de force, he showed that the rent paid for the use of land played no role in determining the Natural Price, or Value, of the grain grown on it.¬Ý He also formulated the very powerful idea of ‚Äúembodied labor,‚Äù meaning the labor expended in previous cycles of production in making the tools, etc., and then as it were ‚Äúembodied‚Äù in them and passed along to the products made with their use.¬Ý This theoretical innovation solved Smith‚Äôs problem in one special set of cases, those that Marx would come to call cases of ‚Äúequal organic composition of capital‚Äù and that later economist would call ‚Äúequal capital intensity,‚Äù but alas, it did not solve the problem in the general case.¬Ý The problem, which even Smith understood quite well, was this:¬Ý Some techniques of production, like agriculture, might use a great deal of labor and relatively little machinery and tools [at least in Smith‚Äôs day], whereas others [a modern semi-automated automobile assembly plant is a great example] might use almost no labor and huge amounts of machinery.¬Ý The quantities of labor required, either directly or embodied, might be the same for wheat and cars, but because so much of that labor had been ‚Äúembodied‚Äù machinery in earlier cycles in the case of the cars, competition would equilibrate the profit rate, so that the labor ‚Äúsitting around‚Äù in the automobile plant machinery, earning as it must an annual rate of return, would drive up the price of the cars relative to the wheat.¬Ý In general, then, it is not the case that in a developed economy, goods exchange in proportion to the amount of labor required for their production.¬Ý Ricardo knew this, and spent the last years of his life unsuccessfully looking for a solution to the problem.

Marx believed he had solved this problem, which had been vexing Political Economists for half a century, but he did not reveal his solution in Volume I of Capital, because he perceived a deeper problem, present even in the special case for which Ricardo‚Äôs theory worked, a problem, Marx thought, whose solution would strip away the mystified surface of capitalism and reveal it for what it really is.¬Ý The problem is this:¬Ý Where does profit come from?¬Ý Think about it.¬Ý Suppose, as Marx would put it, goods exchange at their labor values.¬Ý That is to say, suppose everything offered on the market in a freely competitive capitalist economy exchanges for a price that is strictly proportional to the labor required either directly or indirectly for its production.¬Ý Well, the capitalist buys his inputs and machinery, paying their Natural Price, which by our assumption is proportional to their Labor Values.¬Ý He [the capitalist is always he in those days] then hires workers to work the inputs up into commodities, using the machinery he has bought.¬Ý How much does he pay them for a day‚Äôs labor?¬Ý Their labor is a commodity, like everything else, so its Natural Price or Labor Value is an amount of money with which the worker can purchase the food, clothing, and shelter that he or she needs [the workers, unlike the capitalists, were women as well as men] to ‚Äúproduce‚Äù the commodity he or she is selling to the capitalist, i.e., enough money to live for another day.

The capitalist combines the inputs and the labor in the factory [or rather, he commands that they be combined by the workers, but never mind.¬Ý We must be sensitive to the capitalist‚Äôs feelings and let him think he is actually doing something.]¬Ý The commodities exit the factory embodying the labor that has been expended directly or indirectly on their production, and, this being an ideal Ricardian world, they sell for their Labor Value.¬Ý Good show.¬Ý The capitalist gets back every penny he has laid out to get the process of production going.¬Ý BUT NOT A PENNY MORE!

So, Marx asks, How on earth does the capitalist make a profit?

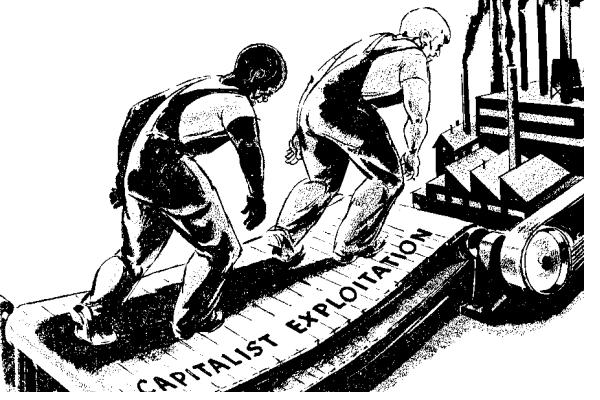

It is at precisely this point that the concept of exploitation enters the discussion.

In a famous and bitterly ironic passage, beautifully translated by Aveling and Moore and Engels himself, Marx writes:¬Ý ‚ÄúMoneybags [geldbesitzer] must be so lucky as to find, within the sphere of circulation, in the market, a commodity, whose use-value possesses the peculiar property of being a source of value, whose actual consumption, therefore, is itself an embodiment of labor, and, consequently, a creation of value.‚Äù¬Ý [Opening paragraph of Chapter vi.]

Now, in economics, one sense of ‚Äúto exploit‚Äù is ‚Äúto extract extra value from something.‚Äù¬Ý Lo and behold, Marx says, descending almost into farce in his eagerness to force the reader to see what really happens in a capitalist economy, profit is the extra labor value that the capitalist extracts from the worker in the factory.¬Ý In short, CAPITALISM RESTS ON THE EXPLOITATION OF THE WORKING CLASS.

How does Marx know that the labor required somewhere in the system to produce the worker‚Äôs good and other necessaries for a day will actually be less than the number of hours the worker labors that day?¬Ý Marx doesn‚Äôt actually tackle that problem, not theoretically anyway, but he is quite right.¬Ý It is a mathematically necessary fact, easily provable with a little Linear Algebra, that if the entire economy generates any physical surplus at all of goods, over and above what is required to run the system for another cycle, then it is guaranteed that the Labor Value of a day‚Äôs labor will be LESS than the number of hours in the work day, no matter how many or how few hours that is.¬Ý What is more, the labor value of the physical surplus will exactly equal the excess labor extracted from the workers, over and above what is required somewhere in the system to produce the worker‚Äôs daily food, clothing, and shelter. All this is even true even for the general case, not just for the special case of ‚Äúequal organic composition of capital.‚Äù

So Marx is right, yes?¬Ý Capitalism really does rest on the exploitation of labor, on the extraction from labor of excess value.

Sigh.¬Ý Not so fast.¬Ý At this point, enter that intrepid Marxist scholar, Robert Paul Wolff.¬Ý [No kidding.]

To put it as simply as possible, I proved mathematically that the very same proposition is true for every single one of the inputs into production somewhere in the system.¬Ý If we define the ‚Äúiron value‚Äù of as commodity as the quantity of iron required directly or indirectly to produce a unit of that commodity, then all of the propositions proved rigorously about labor values will be true for iron values, or corn values, or cloth values.¬Ý [Trust me, all of your immediate objections can be met.¬Ý It is all in my book and my article.]¬Ý Alas, although I proved it independently of anyone else, I was, it turn out, not the first person to prove it.¬Ý A Spanish economist named Josep Vegara proved it a year before I did.¬Ý Oh well.¬Ý So much for immortality.

Does this mean Marx is wrong?¬Ý I was convinced that he was right, but that he simply had the wrong proof.¬Ý So in my article I presented an alternative analysis, complete with proofs.¬Ý I am now going to tell you what I showed, without any of the math.¬Ý For the full-scale theory, which is indeed completely original with me, you have to read the article.

Originally posted here

Close

Close