By J.W. Mason

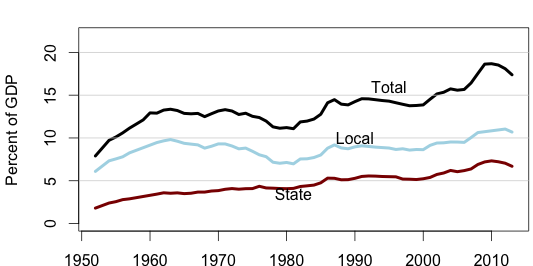

Like most sectors of the US economy, state and local governments have seen a long-term increase in credit-market debt, from about 8 percent of GDP in 1950 to 19 percent of GDP in 2010, before falling back a bit to 17 percent in 2013. [1] While this is modest compared with federal-government and household debt, it is not trivial. Municipal bonds are important assets in financial markets. On the liability side, state and local debt operates as a political constraint at the state level and often plays a prominent role in public discussions of state budgets. Cuts to state services and public employee wages and pensions are often justified by the problem of public debt, municipal bond offerings are a focal point for local politics, and you don’t have to look far to find scare stories about an approaching state or local debt crisis.

Read rest here